‘In-kind donation’ is a term that gets thrown about a lot without any clear definition. An in-kind donation relies on actions and effort rather than monetary value. Posters, leaflets, and even the internet are used to seek in-kind donations.

- Size and Weight of Slipcovers for Swivel Rocking Recliner Chairs

- How To Hang Curtains In A Dorm Room? Step-By-Step Guide

- What Happens To Clothes In Donation Bins? Everything You Need To Know

- What Is Presumed Consent Organ Donation? Everything To Know!

- How To Heat A Tent Without Electricity? Comprehensive Guide

It’s not unusual for someone to ask for our help when they are strapped for cash or resources.

Bạn đang xem: What Is An In-Kind Donation? Examples of In-Kind Gifts

You don’t have to be a volunteer to make an in-kind offering or donation. Some specialists in their field are willing to provide their skills for free as well. The most common kind of in-kind donation is a donation of products, services, or volunteer labor, although Volunteering your time and expertise to benefit others is a popular practice. Learn more about this subject by continuing reading!

What are in-kind donations?

Giving in kind refers to donations of goods and services made by organizations. Building materials, furniture, and appliances are just a few of the many items that Habitat for Humanity welcomes as in-kind donations. Without the help of our corporate partners, Habitat’s work would be impossible.

Our most appreciated in-kind donations are the materials needed to build houses. Habitat for Humanity is one of the top 20 homebuilders in the United States and is privately held. For example, every house built in the United States requires 150 pounds of nails and 400 two-by-fours. The average cost of constructing a three-bedroom Habitat house is $12,000. Companies are invited to provide building materials to assist keep these homes within reach of the average person’s budget.

In some cases, retailers may choose to donate their excess inventory. Habitat for Humanity’s Habitat ReStores frequently sell donated goods to raise money for the organization. In the past, we’ve handled everything from restaurant chain redevelopments to closings.

Whether you’d want to donate construction supplies or unwanted goods for resale, we’d love to hear from you. Looking forward to working with you, we have developed our abilities in this field.

What Is The Best Place To Make An In-Kind Voluntary Contribution?

If we wanted to help, we didn’t have to show up at a set time or place. For example, an act of kindness can serve as a model and provide support to others in the form of in-kind assistance. Many organizations and groups see in-kind contributions and donations on a regular basis, though.

#1. Churches, chapels, and other religious sectors

Have people of your church ever asked you to provide a hand at an event? What does it mean to make a donation in kind? Religious organizations host a wide range of activities and initiatives. Food distribution and gift-giving are two examples. As a result, they’re on the hunt for folks who can’t contribute financially but still help out in other ways.

#2. Blood banks and medical constitutions

Blood and other potentially life-saving resources are constantly sought out by hospitals and medical facilities. Everyone is welcome to join in monthly blood drives that help individuals in need live longer and better lives. Here’s how to boost your iron levels in preparation for blood donation.

#3. Groups that provide humanitarian aid

A hurricane or a wildfire or an earthquake or a tsunami can’t be prevented, for example. There’s a team ready to go in case of one of these catastrophes. With enough money, they’ll look for volunteers to help. All of the meals are made by volunteers. The goods and items they purchased were also packed so that they could be distributed more evenly to people in need.

#4. Animal shelters

Everywhere you go, you’ll find cats and dogs scavenging for food and shelter. This government-run and privately run sanctuary is never short of animals in need of rescue. The dog and cat pound eventually ran out of space to house all the animals. There doesn’t appear to be anything else you can do to make a difference other than adopting. For free, shelters will teach you how to properly care for your dog or cat when you adopt from them. At our animal shelter, euthanasia is sometimes necessary because of a lack of funds.

#5. Orphanage and adoption centers

Because they have no one else to care for them, children in foster care or adoption centers are placed there. In addition, orphanage-related philanthropic organizations provide aid to those in need on major occasions like Christmas.

What Are The Common In-Kind Donations?

As a society, many of us assume that we can only help others when we have money. There are, however, a few types of in-kind donations that are always provided by the vast majority of the population. It may be possible for others to incorporate this aspect into their own philanthropic endeavors as a result of the information we have gathered. What does it mean to say “in kind”? The following are some of the most often used:

#1. Old clothes, toys, and furniture

A children’s orphanage; a shelter for homeless people; or victims of natural catastrophe can all benefit from our donated goods.

#2. Foods

The needs of those who aren’t directly impacted are prioritized whenever a crisis occurs. Canning goods, noodle packs, and biscuits with lengthy shelf lives are among the most sought items. After being collected, these products were repackaged numerous times to guarantee equal distribution.

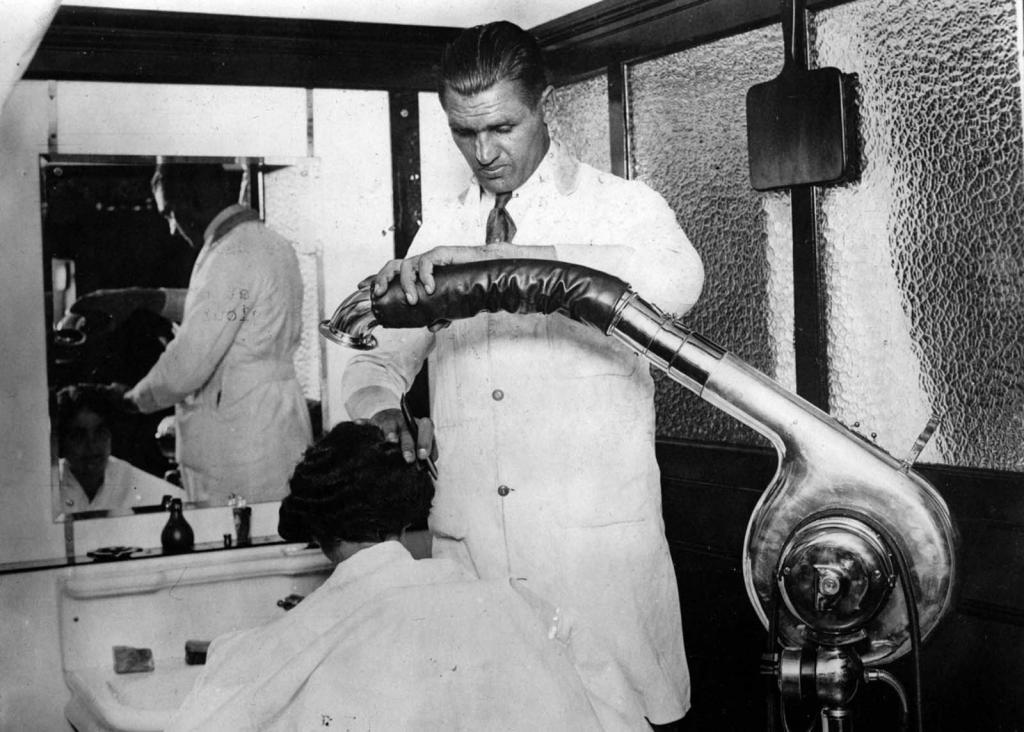

#3. Service and skills

Xem thêm : How to Fold a Pet Gear Stroller? A Step-by Step Learning Guide

People who were unable to contribute financially or volunteer their time are still able to give back. In addition to providing free health exams, they also offer other services including transportation and appliance repair.

#4. Blood

Who would have guessed that our blood would be used as a form of in-kind contribution? Medical centers and blood banks, for example, are eager to accept donations that are specifically customized to meet their needs. Because they know their contribution could save someone else’s life, those who have given blood appreciate the opportunity to do so. The significance of blood donation has been well documented.

In-Kind Donations

The term “gift in kind” is used to describe any donation that is not made in the form of currency. The most prevalent types of in-kind donations include:

- However, a gift in kind, as defined above, is any non-monetary contribution to an institution. In-kind donations fall into three categories:

- An in-kind donation is any donation that doesn’t directly contribute money to a specified purpose as defined above. There are three basic categories of in-kind donations that can be subdivided into:

- Amount paid to a third party creditor on behalf of the organization.

When done appropriately, an in-kind donation can benefit both the donor and the recipient. Extra products that would otherwise be thrown out at a loss could be given away by donors. They can buy what they need without using up any of their operating budget. In this way, both parties can get the benefits of a more powerful effect for less money.

When a natural disaster occurs, for example, these donations could be particularly powerful. When a disaster strikes, a charitable organization can alleviate the financial burden on itself and the people it serves by providing medical supplies, construction materials, and even human labor to a deserving cause.

The final type of donation is in-kind, which is made up of things that might otherwise end up in a landfill. They can be repurposed, upcycled, or given out by charitable organizations.

Examples of In-Kind Gifts

A number of forms and sizes of in-kind donations are possible. Donations of computers and office supplies can save money for charitable organizations. Clothing and other necessities that might be given to persons in need by non-profit groups, for example

Both an organization’s or a recipient’s needs and the type of donation made have a strong match in both instances. Such a criteria must be met for an in-kind donation to be considered successful.

Unproductive gifts can result from a lack of communication between donors and organizations or a misunderstood understanding of a nonprofit’s needs and mission.

Shipping to another country may be more expensive than purchasing locally, so a donation may not be an ideal match. Donating money is the best course of action in this case.

What Are The Best In-Kind Gifts?

As previously said, organizations really appreciate in-kind donations of functional computers and office equipment. Additionally, these companies’ operational budgets suffer as a result of the expense of legal and accounting services, which can quickly add up. Consequently, any donation that reduces a nonprofit’s overhead costs is a beneficial one. If you work for one of these companies, don’t be shy about reaching out for assistance. If you work for a company that has unsold goods or services that may be donated, consider contacting a local charitable organization. Remember that a successful gift is all about good communication.

Non-profit organizations might greatly benefit from donations of working computers and office supplies. Rather of relying on expensive legal and accounting services, nonprofits can explore for alternatives that are more cost-effective. As long as the nonprofit’s overhead costs are reduced, every donation will be welcomed. When looking for assistance, consider contacting corporations that may be able to help; you may be surprised to learn who is willing to help. Consider contacting a non-profit in your area to see if your company has any extra inventory or resources that may be put to good use. Remember that effective communication is the key to a successful gift.

The Worst In-Kind Gifts

The worst kind of present is one that is given merely to make the giver look good, regardless of whether or not the recipient would actually profit from it at all. This may be the case, depending on the type of the present and the number. In a time of disaster, having supplies like clothing and medicine on hand can be quite helpful. A certain amount of additional donations, on the other hand, has the capacity to both fail to aid and burden individuals who receive them. It’s critical to think about the recipient of your donation while making a gift. If you don’t understand something, ask for clarification.

USAIDS’s Center for International Disaster Information (CIDI) has compiled a list of the worst in-kind donations ever donated, including discarded soap, dog food for starving children, and baby formula that required water to make (in an enivironment with contaminated water).

What Is a Gift-In-Kind Letter

In the case of an in-kind donation, a letter stating that the donation is in that form is common. There are tax ramifications to the nonprofit organization’s thank-you letter sent to a donor (more on that later). A charity’s EIN, the identity of the donor (individual or corporate), and any other pertinent information should be provided. Taking in a tangible donation might save a lot of money for charitable organizations. While it may be more difficult to put a dollar value on intangible contributions, they are just as important and should be acknowledged.

Including the name of the creditor and the amount paid on behalf of the organization in the gift in kind letter is a good practice.

Xem thêm : How To Wash Pack N Play Sheets? Helpful Tips To Remember

An IRS-qualified appraiser can be hired by the receiving organization if the donation’s exact value cannot be ascertained.

Gift-In-Kind Receipt

Even though an acceptance letter functions as an in-kind donation tax receipt, it is the donor’s responsibility to keep accurate records for tax purposes. If the acknowledgement letter omits any of the following details, the donor should request a donation in kind receipt.

- The name of the non-profit.

- Name of the Donor

- Here’s a complete list of everything distributed.

- The monetary worth of the donation.

- organization’s comment as to whether or not they gave anything back in return

In-Kind Donations and the IRS

Reporting charitable contributions to the IRS entails a slew of requirements that must be met. In order to appropriately reflect the contributions made and to comply with tax law, you need an accountant who is familiar with in-kind gifts and the standards that govern them.

As long as the nonprofits you donate to are 501(c)(3) nonprofits, you can deduct the money you provide to them on your federal income tax return as long as it is used for charitable purposes. Because they are required by law to make their status public, these organizations are easy to spot.

To qualify for a charity deduction on your personal tax return, you must be a member of a corporation. However, the fair market value of the item cannot be deducted from direct costs in partnerships or sole proprietorships. It is possible to deduct the expense of making a computer donation of $X, but not the profit made from selling the computer. However, this is not the case for C companies (any corporation that pays its shareholders’ income taxes, but not the corporation itself) (those which are taxed directly, not through their shareholders). These are eligible for a larger deduction if certain conditions are met—either the midway point between the cost and fair market value or double the cost, whichever is lower—are met.

Deducting the value of a non-cash donation does not qualify as a tax deduction. If, for example, you charge $150 an hour for legal advice and donate three hours of your time to a charity as an in-kind donation, you cannot deduct the $450 you would have received. Transportation, accommodation, food and beverage expenditures, and any other costs paid while providing these services can all be deducted from taxable income. You’ll need to keep thorough records if you wish to deduct these costs from your taxable income.

In-Kind Donations for Nonprofits: Additional Resources

We’ve covered a lot of territory here, but if you want to dig deeper into the topic of charitable giving, there are plenty of excellent resources available.

Gift Acceptance Policy

Many firms in the United States donate regularly to charity causes.

Recognizing and Acknowledging Gifts of Kindness

Consider These Questions Before Accepting In-Kind Donations

Why are they important?

Cash and grant donations are preferred by any non-profit organization. In-kind gifts can have a substantial influence on both large and small non-profit organizations.

Donations of goods or services in kind can take many forms, from architectural services to the donation of office supplies and even the donation of water to a capital project. Free advertising space in a magazine is one thing, but a wine company may provide a few bottles of wine to a charity event as another option. An individual can make a donation of furniture or clothing to a refugee support organization. All of them have been donated in kind.

It is impossible to overestimate the importance of in-kind donations when applying for grants. Many federal funders and even some private ones require grant applicants to make “matching payments,” which are sums of money donated in proportion to other funding or support. Cash-strapped NGOs may employ in-kind contributions to demonstrate a match, for example, in the amount of work or space contributed to a certain project.

Contributions in kind are tax-deductible for commodities, but not services, under the fair market value rule.

It’s A Wrap!

You now have the power to take advantage of the fact that an in-kind donation can extend your budget and help you achieve your goals. Thus, they provide a new way for philanthropic organizations to connect with the people and organizations in their communities. The term “in-kind donation” has already been defined for you.

Nguồn: https://spasifikmag.com

Danh mục: Blog