What does it mean to have a fiduciary duty in the context of insurance? An employee’s fiduciary obligation is the pledged duty to behave in the best interests of their employer. When making financial decisions, they must consider their employer’s movements and thoughts.

- How To Start A Donation Drive? Complete Step-by-Step Guide

- How To Make A Donation In Someone Elses Name? Things You Should Know

- How Do I Stop A Recurring Donation? Ultimate Guide

- What Is Presumed Consent Organ Donation? Everything To Know!

- Where Can I Find Clothing Donation Bins? Everything To Know!

A fiduciary is a person who manages the financial affairs of another party on their behalf in exchange for payment. They have no responsibilities to any other business except their own. For the insurer, their main obligation is to choose the most financially advantageous course of action.

Bạn đang xem: What Is The Definition Of A Fiduciary Responsibility? Investment Fiduciary Guidelines

For insurance purposes, a fiduciary is in charge of determining which policies are the greatest fit for the client, keeping up with policy changes, and paying the associated expenses. In the event of an accident, for example, they will step in to handle the situation and contact the insurance company to inform and prepare the necessary paperwork. Insurers have a legal obligation to have a point of contact for companies. Insurance language can be difficult for insurers to understand, and a translator can help the organization better understand the insurer’s issues.

In the context of insurance, what is a fiduciary’s obligation?

What is Fiduciary Responsibility?

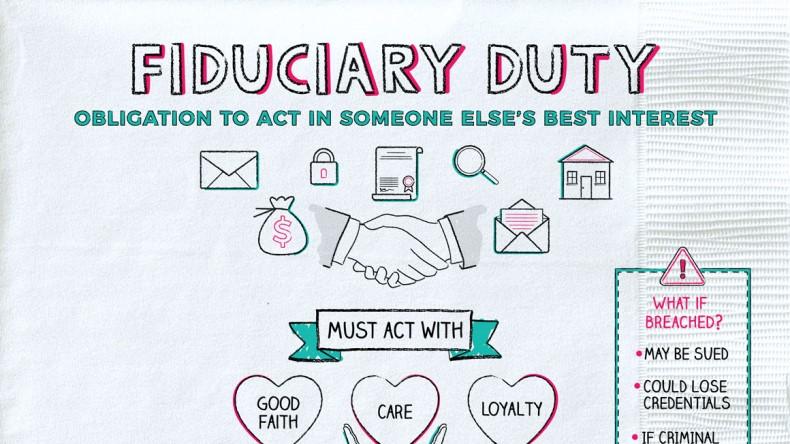

Fiduciary responsibility refers to a party’s duty to behave only in the interests of the other party when dealing with another party. It’s the gold standard of health care, and for good reason.

The fiduciary is the person tasked with the duty of acting in the role of a fiduciary. Fiduciary duties are typically owed to the person referred to as the principal or beneficiary.

Because of this legal responsibility, the fiduciary must guarantee that there is no conflict of interest between themselves and their client, the beneficiary. Unless the fiduciary and the client agree otherwise, the fiduciary is unlikely to make a profit in most instances.

Profits must be reported if fiduciary duties have been violated. Even if no injury was done, the beneficiaries would be entitled to a variety of damages.

To encourage people to specialize and take on fiduciary responsibilities, fiduciary duties have been introduced. In order to prevent beneficiaries from being misused, numerous laws were enacted. Beneficiaries will have more peace of mind knowing they are well-protected as a result.

A fiduciary who handles investments manages someone else’s money for them. In return for their trust, they are expected to uphold their end of the bargain.

When the beneficiary has faith in the other person, this form of relationship is usually granted. Even if you respect the other person’s character or judgment, it’s not always enough.

This person has an obligation to act honestly and loyally in regards to any property they may have in their care or the trust they are entrusted with. For the beneficiary’s benefit, all actions are taken with the beneficiary’s assets at all times.

Fiduciaries are expected to be knowledgeable and experienced in the assets they would be managing. In all matters, such as in the purchase of a piece of property or in a business venture, the focus must always be on the best interest of the principal. This requires that the fiduciary be absolutely candid with the beneficiary.

Corporations and fiduciary duties

Fiduciaries are expected to be knowledgeable and experienced in the assets they would be managing. In all matters, such as in the purchase of a piece of property or in a business venture, the focus must always be on the best interest of the principal. This requires that the fiduciary be absolutely candid with the beneficiary.

As a potential fiduciary, you are expected to have more knowledge and practical experience in the assets that you are responsible for. In all circumstances, such as in the purchase of a piece of property or in a commercial venture, the focus must always be on the best interest of the principal. As a result, the fiduciary must be completely forthright with the recipient.

Decision-making accuracy will be affected by the amount of information, the length of time available to obtain the information, and the counsel offered. In order to protect the company’s assets and owners, all information must be examined attentively.

According to the Delaware Supreme Court, the term “Duty of Loyalty” means that directors and officers cannot utilize their positions of authority and the trust placed in them by the public to further their own personal agendas.

A long-standing public policy mandates that corporate leaders devote the utmost attention to their responsibilities, which include but are not limited to:

- Defend the company’s long-term goals.

- Don’t do anything that could hurt the company’s reputation.

- Make sure the company isn’t losing out on profit opportunities because they aren’t using their greatest skills or making the most money feasible.

According to the concept of “Duty of Good Faith,” a corporate director must act in the best interests of the company, avoid violating the law, and faithfully carry out their obligations.

Duty of Confidentiality is a concept used to describe the obligation for corporate directors to keep company information private and not utilize it for personal gain.

As a trustee, you must exercise caution, care, and expertise when administering a trust.

Directors are expected to act with “full candor” in accordance with their duty of disclosure. This may necessitate disclosing all the conditions and information underlying a decision made by the board to the stockholders.

If the decision is challenged in court, the judge is likely to assume that the board of directors acted in good faith and with the belief that it was in the best interests of the company. As a result, courts rarely delve into why a director made a certain decision, assuming the director believed it was in the best interests of the company.

Occasionally, courts have allowed charity officers to operate under their own set of guidelines. Decisions that benefit them individually may be permitted. As long as there was no financial impact on the charity, this practice has been common. It doesn’t give officers the go-ahead to siphon off the charity’s earnings for their own gain.

Fiduciary responsibilities may be assumed in specific situations, depending on the nature of the relationship. As a doctor and patient, a pastor and member of the church, a lawyer and client, etc. can attest to, this principle applies to all of them. In the event of a contract, the same holds true. As a result, one individual can exert some control over the other.

Despite the fact that each state’s approach to fiduciary transactions differs, most favor the beneficiary. A contract can be annulled, a transaction declared invalid, or a declaration of voidability can be issued between a fiduciary and a beneficiary. In the event of a dispute, the fiduciary must show that the transaction was fair in court.

KEY TAKEAWAYS

- A fiduciary is legally obligated to put the interests of their client above their own.

- Trustees and beneficiaries, corporate board members and shareholders, executors and legatees, and others all have fiduciary responsibilities.

- A member of a charity’s investment committee, for example, is a type of investment fiduciary because they are legally responsible for managing the funds of the organization.

- Regulated investment advisors have a fiduciary duty to their customers, but broker-dealers are only required to meet the less strict suitability criterion, which does not entail placing the client’s interests ahead of their own.

Understanding a Fiduciary

The obligations and duties of a fiduciary are both ethical and legal. They must behave in the best interest of the principal, which is the client or party whose assets the fiduciary is managing when they accept responsibility. “Prudent person standard of care” is a term that dates back to an 1830 court decision. As a result of this definition of the prudent-person rule, fiduciaries were obligated to put the interests of their beneficiaries first and foremost. Strict measures must be taken to guarantee that the fiduciary’s interests do not diverge from those of the principal.

Unless express consent is given at the beginning of the partnership, in many circumstances there is no profit to be earned. Keech vs. Sandford is an English High Court case in which a fiduciary cannot profit from their position (1726). Fiduciaries can keep whatever benefits they have received, whether they are monetary or more broadly defined as a “opportunity.” If the principle gives their agreement, the fiduciary can keep any benefits they have gotten.

A wide range of common commercial interactions, such as those involving:

- Beneficiary and trustee (the most common type)

- Directors and stockholders of a corporation

- Executors and legatees are two different types of beneficiaries.

- Wards and a watchful eye

- Propagandists and buyers of stock

- Clients and lawyers

- Corporations that invest money and individuals that do

- Policyholders and insurance firms or agents

Fiduciary Relationship Between Trustee and Beneficiary

As part of an estate plan and a trust, there must be a trustee and a beneficiary. The fiduciary is the person who serves as the trustee of a trust or estate, and the principle is the person who receives the benefits of the trust or estate. It is the job of the fiduciary, as trustee or beneficiary, to manage trust assets on behalf of the trust’s beneficiaries. In estate law, the trustee is also referred to as the executor of the deceased’s estate.

As long as the beneficiary has a rightful claim to ownership, the trustee must act in that person’s best interest. Comprehensive estate planning necessitates careful consideration of who will serve as the trustee and who will be the beneficiary.

It is common for politicians to set up “blind trusts” in order to avoid conflicts of interest. When a trustee is responsible for the investing of a beneficiary’s corpus (assets) without the beneficiary’s knowledge, the term “blind trust” is used. The trustee has a fiduciary duty to invest the fund in accordance with prudent person standards of conduct even if the beneficiary is unaware.

Fiduciary Relationship Between Board Members and Shareholders

In the same way that bank directors are trustees for bank depositors, corporate directors can be seen as trustees for stockholders when serving on the board of a financial institution. Included in these responsibilities are:

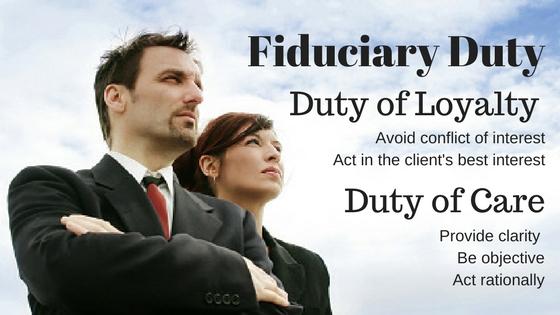

The Duty of Care

The board’s decisions for the company’s future are subject to the duty of care. The board of directors has a responsibility to thoroughly examine all conceivable decisions and their potential impact on the company. Even while it may be tempting for the board of directors to vote for one particular candidate, it is their responsibility to thoroughly study all potential candidates before making a final decision.

The Duty to Act in Good Faith

Even if the board conducts a thorough investigation into all available possibilities, it is ultimately responsible for selecting the one that it believes will best serve the company’s and its shareholders’ interests.

The Duty of Loyalty

In other words, the board must put the interests of the company and its investors ahead of all other considerations. The interests of the company should always come first in the minds of board members, regardless of their personal or professional interests.

While it’s a common misconception, a business is not required by law to maximize shareholder return.

If a director of a corporation is determined to have violated their fiduciary duty, the company or its shareholders have the right to bring legal action against that director.

Fiduciary Relationship Between Executor and Legatee

Fiduciary activities can also be applied to one-time or limited-time events. If the property owner needs an executor for a sale, a fiduciary deed can be utilized to transfer the property rights to the fiduciary. Fiduciary deeds are helpful in situations where a property owner intends to sell but is unable to manage their affairs owing to illness, incompetence, or other conditions and needs someone to act in their stead.

It is illegal for a fiduciary to profit from the sale of a property without disclosing to the buyer the exact status of the asset being sold. Fiduciary deeds are helpful when the property owner is deceased and the property is part of an estate that requires management or control.

Fiduciary Relationship Between Guardian and Ward

The legal guardianship of a minor is passed to a designated adult under a guardian/ward relationship. It is the duty of the fiduciary to see to it that the minor child or ward receives proper care, which may include making decisions about where the minor attends school, what medical care the minor receives, how the minor is disciplined, and how the minor’s general welfare is preserved.

Whenever the natural guardian of a minor child is no longer able to look after the kid’s needs, a guardian is appointed by a state court. Up until the age of majority, the link between guardian and ward is generally maintained in most states.

Fiduciary Relationship Between Attorney and Client

Fiduciary relationships between attorneys and their clients are some of the most rigorous. As a fiduciary, an attorney is bound by the highest standards of justice, loyalty, and honesty in all of his or her interactions with clients, according to the Supreme Court of the United States. 1

Xem thêm : Puppy On Wheels: 10 Steps on How To Make A Dog Stroller?

For breaches in fiduciary duty by the client, attorneys are held responsible and accountable to the court in which that client is represented.

Fiduciary Relationship Between Principal and Agent

The principal-agent relationship serves as a more general illustration of fiduciary duty. A principal or agent can be any individual, corporation, partnership, or government agency, as long as the entity has the legal power to do so. Legally, an agent is appointed to operate on behalf of the principle without any conflict of interest, under a principal/agent responsibility

Fiduciary duty is implied when a group of shareholders elects members of the company’s management or C-suite to act on their behalf as agents. In the same way, investors are acting as principals when they choose investment fund managers to handle their assets.

Investment Fiduciary

A “fiduciary” is anyone who has legal responsibility for managing someone else’s money, even if they don’t look like a financial professional (such as a money manager or a banker). Because of your involvement with the investment committee of your local charity or other organization, you have a fiduciary duty. You’ve been given a lot of confidence, and betraying that trust could have serious repercussions.

Additionally, the committee members’ responsibilities are not completely relieved by bringing in a financial or investment specialist. They still have a duty to choose and oversee the expert’s activities with care. ”

The Suitability Rule

A broker-suitability dealer’s responsibility is usually all that is required of them because they are paid by commission. This is described as giving suggestions that are in line with the underlying customer’s requirements and preferences. Under the rules set by the Financial Industry Regulatory Authority (FINRA), brokers are required to provide their clients with appropriate advice.

Only if the broker-dealer reasonably believes that any suggestions they make are appropriate for their client’s financial goals, objectives and unique circumstances does the appropriateness standard require broker-dealers to put their interests above those of their clients. In terms of loyalty, there is an essential distinction: Their employer, the broker-dealer for which they are employed, is the principal responsibility of a broker.

Another way of describing appropriateness is that they make sure that their recommendations are appropriate for the client and that they do not impose excessive transaction fees on the client. Excessive trading, churning the account for commissions, and often changing account assets to create transaction income for the broker-dealer are examples of inappropriate behavior.

A broker’s disclosure requirements for conflicts of interest are less stringent; an investment merely needs to be suitable, not necessarily consistent with the particular investor’s aims and profile.

Broker-dealers and their clients may disagree about the appropriateness of the suitability requirement. Compensation is the most obvious source of contention. An investment advisor is banned from purchasing a mutual fund or other investment on behalf of a client under a fiduciary standard because doing so would result in a greater fee or commission for the broker than an option that would be less expensive for the client—or yield more for the customer.

Investing on behalf of a client is permissible if the investment is suitable for the customer. This can also encourage brokers to promote their own products rather than compete for products that may be less expensive.

Suitability vs. Fiduciary Standard

A Registered Investment Advisor (RIA) has the same level of fiduciary obligation as the investment committee. A broker, on the other hand, who is employed by a broker-dealer, is prohibited from doing so. The fiduciary status of some brokers is neither desired or permitted by some brokerage businesses.

The Investment Advisers Act of 1940 imposed a fiduciary standard on all investment advisors, regardless of their fee structure. If the SEC does not regulate them, state securities regulators have authority to do so. According to the legislation, a fiduciary is defined as someone who has a responsibility of loyalty and care to their client, which implies they must put their customer’s best interest ahead of their own. 2

A financial advisor cannot buy stocks for their own account before purchasing them for a customer, and they are not allowed to make trades that could result in increased commissions for the advisor or their investment firm.

Investment advice should be based on correct and comprehensive information—basically, an advisor must do their utmost to ensure that the analysis is thorough and accurate. When serving as a fiduciary, an advisor must disclose any potential conflicts of interest in order to put the client’s interests ahead of his or her own.

This also means that the adviser must trade assets using a “best execution” criterion, which requires them to look for the most cost-effective and efficient way to trade.

The Short-Lived Fiduciary Rule

While the term “suitability” was the standard for transactional or brokerage accounts, the Department of Labor Fiduciary Rule sought to toughen things up for brokers.. This requirement, rather than the appropriateness standard, would apply to anyone who has retirement funds under management and makes recommendations or solicitations for an Individual Retirement Account (IRA) or other tax-advantaged retirement account (TRAA).

For a long time, the execution of the fiduciary rule has been murky. It was originally slated to take into effect between April 10, 2017, and January 1, 2018, when it was first introduced back in 2010. After the inauguration of President Trump, the deadline was pushed back to June 9, 2017, with a transition period lasting through January 1, 2018.

As a result, the rule’s full implementation was delayed until July 1, 2019. After a June 2018 decision by the Fifth Circuit Court of Appeals, the rule was vacated. 3

The Department of Labor released Proposal 3.0 in June 2020, which “reinstated the investment advice fiduciary definition in effect since 1975 accompanied by new interpretations that extended its reach in the rollover setting, and proposed a new exemption for conflicted investment advice and principal transactions.” 4

It’s not yet clear if President Biden’s new administration will approve it.

Risks of Being a Fiduciary

“Fiduciary risk” refers to the likelihood of a trustee or agent who isn’t acting in the best interest of the beneficiary. Not all of the trustee’s resources are being used for their own gain; this could be the risk that the trustee isn’t getting the optimum value for their beneficiaries.

A fiduciary risk can arise when a fund manager (agent) makes more trades than necessary for a client’s portfolio, resulting in higher transaction costs for the customer than are necessary.

“Fiduciary abuse” or “fiduciary fraud” refers to situations in which an individual or entity who is legally assigned to manage another party’s assets utilizes their power in an unethical or illegal manner to benefit financially, or serve their own self-interest in some other way.

Fiduciary Insurance

The company’s directors, officers, workers, and other natural person trustees can be insured by a business as fiduciaries of a qualifying retirement plan.

Employee benefits liability and director’s and officer’s liability plans are aimed to fill in the gaps in the coverage provided by fiduciary liability insurance. Due to scenarios such as alleged mismanagement of money or investments; administrative errors or delays in transfers and payments; a change in benefits; erroneous advice surrounding investment allocation within the plan; and litigation; it provides financial protection.

Investment Fiduciary Guidelines

The nonprofit Foundation for Fiduciary Studies was founded to outline the following responsible investment practices in response to the demand for assistance for investment fiduciaries:

Step 1: Organize

The first step is for fiduciaries to familiarize themselves with the relevant laws and regulations. Fiduciaries need to establish the roles and obligations of all parties participating in the process after determining their governing norms. Using investment service providers necessitates the use of written agreements.

Step 2: Formalize

Once the investment program’s aims and objectives have been established, the process of formalizing the investment process can begin. Investment horizon, risk tolerance, and expected return are all important considerations for fiduciaries. Using this approach, fiduciaries are able to make informed decisions about investments.

In order to build a diverse portfolio, fiduciaries need to select the right asset classes that can be justified. The modern portfolio theory (MPT) is one of the most widely accepted strategies for designing investment portfolios that aim to achieve a desired risk/return profile, therefore most fiduciaries utilize it.

Finally, the fiduciary should formalize these stages by drafting an investment policy statement that provides the required specificity for implementing a specific investment strategy. Now that the fiduciary has completed the first two steps of the investment program, they are ready to go on to the next step.

Step 3: Implement

When the investment policy statement is implemented, specific investments or investment managers are chosen to meet those needs. In order to assess possible investments, a due diligence procedure must be established. Criteria that can be used to analyze and sort through investment choices should be identified during due diligence.

Because many fiduciaries lack the expertise and resources to carry out this phase on their own, investment advisors are sometimes called in to assist. Fiduciaries and advisers must coordinate during the implementation phase to verify that a mutually agreed-upon due diligence procedure is being applied in the selection of investments or management.

Step 4: Monitor

Finalizing a project can be both time-consuming and overlooked. After successfully completing the first three phases, some fiduciaries don’t think it’s necessary to keep an eye on their portfolios. Because fiduciaries could be held accountable for carelessness at any phase, they should not overlook any of their duties.

Fiduciaries must regularly analyze reports that compare the performance of their investments to the relevant index and peer group in order to properly monitor the investment process and decide whether the investment policy statement objectives are being accomplished. It’s not enough to just keep an eye on the numbers.

Investment managers’ organizational structures, for example, should be under constant scrutiny by fiduciaries. Investors must take into account any changes in the organization’s investment decision-makers or their level of authority, and how this could affect future performance.

In addition to performance evaluations, fiduciaries must also assess the costs of the procedure. The fiduciary is not only accountable for the investment of funds, but also for the expenditure of funds. Fiduciaries must guarantee that the fees paid for investment management are fair and reasonable because they have a direct impact on performance.

Current Fiduciary Rules and Regulations

Federal savings associations and their fiduciary activities in the United States are regulated by the Office of the Comptroller of the Currency, a Treasury Department agency. Real estate agents and lawyers frequently run into conflicts of fiduciary duty as a result of their dual roles as real estate agents and attorneys. Even if two opposed objectives may be balanced, that does not equate to serving a client’s best interests.

Individuals can have their fiduciary certificates removed by the courts if they are deemed to have neglected their duties while holding a position of trust. Passing an examination that examines their understanding of laws, policies and security-related procedures such background checks and screening is required to become a certified fiduciary Volunteers on the board do not need to be certified, but it is still necessary to verify that the professionals performing the responsibilities have the relevant credentials or licenses.

In Terms Of Insurance, What Does Fiduciary Responsibility Mean?

When it comes to insurance, what exactly is a fiduciary duty? Let’s imagine that you, the insurer, are contemplating or applying for an insurance coverage. There is, however, a snag. If you don’t understand the intricacies of policymaking, how can you begin? Then, what do you do?

An accountant is summoned to your aid. Payroll deductions will be applied to the accountant. Their employment with you will be protected by this fact. It has been established that you have a fiduciary relationship. The fact that they pay your wages is your legally binding clause. Your money will be well spent if you offer them what they deserve.

In addition to having a paycheck, you have the power to ensure that your employee is looking out for your interests because of this. If they work for you, you can count on them to keep your private information safe while also being attentive to your demands. Accountants are bound by an invisible contract to behave in the best interests of their clients, so long as they accept the money they have received from you. Despite the fact that they make all of their own decisions, they do so with an eye toward how they affect you.

To put it another way: You’d like to apply for insurance, but you lack the requisite expertise to do so. That’s why your accountant will be happy to help. They will handle all of the correspondence between you and your insurance provider on your behalf. They have a fiduciary duty to act on your behalf when it comes to making financial decisions.

Xem thêm : How To Dye A Tula Blanket? Comprehensive Guide

It is up to them to tell you if you’re making the incorrect decisions, and you can’t interfere with that. They’ll help you stay on top of your finances and make smart financial decisions. In addition, they must stay abreast of current economic conditions, including inflation and deflation, and choose the best course of action to take in order to maintain their position.

Fiduciary obligation is defined under the law in the following way.

What Are Fiduciary’s Job And Obligation?

In today’s world, money may as well be the most valuable commodity. It’s important to know exactly what the person you’re handing over financial obligations to is responsible for and how much faith you can put in them. The fiduciary duty includes the following:

#1. Employer above all others

If you and your fiduciary don’t know each other well, it’s highly suggested that you have a written contract in place. In this approach, you will be able to demonstrate that they have a legal obligation to act on your behalf.

For your trust in their abilities and reliability, you need to underline their responsibilities and terms in your contract. After that, they’re meant to behave in your best interest when it comes to your finances. Your assets and charitable intentions should guide their financial actions.

It’s critical to keep in mind that their activities should always serve to enhance your financial situation, not to put you in more debt. If this occurs, look for a clause in your contract that indicates that you expect them to do so.

#2. A good image

An specialist in financial matters must preserve an honorable and trustworthy reputation in order to attract clients with personal concerns. They must not only make a strong first impression on their employer, but they must also keep it throughout the term of the contract. Nevertheless, the insurer is also in charge of this. As a result, it is imperative that you exercise caution while making a decision, especially if you are not well-versed in financial concerns.

#3. Protect against threats and claims

In addition to financial expertise, a money expert should be devoted to his or her profession. Once they take your payment and sign your contract, they are bound to give you their whole attention. It doesn’t matter if you’re there or not; they have a duty to safeguard your money. It is their responsibility to ensure that you lose as little money as possible in the event of an accident that requires insurance. Even if your will is being challenged or money is being used against your wishes, a fiduciary will take care of it.

Who is Considered as a Fiduciary?

As an investment committee member, you can delegate some of your responsibilities to the committee’s investment advisor. If the adviser is a Registered Investment Advisor, he and the other members of the committee have fiduciary responsibilities. Many brokerage firms will not allow their brokers to become fiduciaries because they believe they do not have the freedom to do so.

The advisor’s actions determine whether or not they are considered fiduciaries. They are deemed a fiduciary if they give advise on a regular basis. You can’t call someone a fiduciary if they’re just selling things.

A Fiduciary’s Responsibilities

A fiduciary’s principal duty is to use caution when making financial decisions. A prudent approach to investment decisions can be seen in the method by which they go about it. They’ll need some sort of blueprint.

Prudence in investing decision-making and management is a requirement for a fiduciary. As a result, fiduciaries must have a basic strategy for carrying out their duties. The Foundation for Fiduciary Studies (FFS) is a non-profit organization that provides counsel to fiduciaries.

When it came to making financial decisions, they were instructed to follow a number of conservative guidelines. The first rule of thumb is to become familiar with the rules that govern your situation on your own. Retirement plan investment fiduciaries should get familiar with the Employee Retirement and Income Security Act (ERISA) and all of its rules and regulations. They must first identify their own duties and those of others engaged before they can assign responsibilities and roles to others. Service agreements must be in writing if they are going to hire a service provider.

Once the regulations and roles are established, the following stage is to create the investment program’s aims and objectives. For example: a fiduciary must identify a variety of criteria, including:

- time horizon for an investment.

- The level of risk that you’d like to take.

- Return on investment.

The fiduciary will have the framework necessary to analyze alternative investment options after these things are determined.

Using some sort of process, they can then identify asset classes that allow them to build a diversified portfolio. Most of the time, a fiduciary will use modern portfolio theory (MPT) to select the asset classes. It gives customers the ability to select asset classes depending on risk and return objectives.

Formalizing the aforementioned procedures is the first stage in developing an investment policy statement. In order to follow a specific investing strategy, the statement will supply all the essential information.

It is necessary to choose specific assets or specific investment managers in order to meet the conditions outlined in the policy statement when implementing it. Due diligence is required when evaluating any new investment, and a process must be devised for it. Identify the criteria for evaluating and selecting investment choices.

Due to a lack of resources, knowledge, or experience on the part of fiduciaries, this phase is frequently delegated to a professional advisor. In order to guarantee that due diligence is conducted when selecting assets or managers, communication between fiduciaries and advisers is crucial.

The most time-consuming part of the process is typically overlooked. In the event a fiduciary is negligent in any or all of these processes, they could be held responsible for all of them.

Fiduciaries are responsible for regularly reviewing investment reports and determining whether or not the investment policy statement’s goals are being met by comparing their investment’s performance to that of the appropriate index and peer group.

It’s not enough to simply monitor performance metrics. Qualitative data must also be monitored by a fiduciary. An investment manager’s organizational structure can change as a result of this. When a company’s leadership shifts, it’s important to know how this will effect the company’s future success.

The costs associated with putting the approach into action must also be examined. A fiduciary is in charge of both the investments and the expenditures made with the money entrusted to them.

Fiduciaries need to know how various fees affect performance and whether or not they are fair and reasonable.

There can be confidence in the work of investment committee members and trustees when all of the above processes have been followed. The most important thing is that they use caution at all times.

Some Examples of Fiduciary Duty

According to the existing legal system, fiduciaries have many responsibilities. Principal and agent roles are all included here, as well as guardian and ward roles, trustee and beneficiary roles and attorney and client roles.

A fiduciary duty exists between the trust and the chosen beneficiary when one is formed from an estate. Assets in a trust are owned by the trustee, who is the designated party in charge of them. Because the beneficiary holds the equitable title to the property, the trustee must make all decisions in the beneficiary’s best interest. The person who will be the trustee must be carefully considered in a thorough estate plan.

The appointed adult has legal custody of the minor in a guardian/ward situation. As a fiduciary, the role of guardian entails providing a variety of services to the kid, including:

- Choosing a school for the child.

- Acquires top-notch medical attention.

- It’s given the right training and discipline.

- Is fed and clothed adequately, and so on.

When parents are unable to care for their children, the state court appoints a guardian. Until the child reaches the legal age of majority in the majority of states, the parent-child relationship stays unchanged.

Fiduciary duties can also be seen between the principal and his or her agent. As long as it is permissible to do so, a wide variety of principals and agents can be created. An individual, a partnership, a company, or a government body can engage in this type of negotiation. To represent the principal, an agent must be chosen, and that person must be free of any conflicts of interest.

Shareholders can appoint C-suite executives or managers to act as their agents, demonstrating the principal-agent relationship and the associated fiduciary obligation. Choosing a fund manager to manage your money is another example of investors becoming principals. As a result, the manager serves as a sort of intermediary.

An attorney-client relationship is one of the most restrictive in terms of fiduciary duty. There must be total trust and confidence between them, according to the Supreme Court of the United States. Each time an attorney represents a client, the fiduciary is obligated to act fairly, with integrity and faithfulness. Attorneys who violate their duty of fiduciary care are subject to disciplinary action by the courts.

Post your legal requirement on UpCounsel’s marketplace if you’re not sure if you have fiduciary obligation or if you want additional clarity on what those responsibilities are. Only lawyers with advanced degrees from prestigious law institutions like Harvard Law and Yale Law, as well as experience of at least 14 years, are accepted into the UpCounsel legal network. Google, Menlo Ventures, and Airbnb are just a few of the companies they’ve worked for or on behalf of.

FAQs

What Is a Fiduciary?

When acting on behalf of another, a fiduciary is bound by a duty of good faith and trust to behave in the best interests of the person or people they are representing. As a result, in order to qualify as a fiduciary, one must be obligated by both legal and ethical obligations to act in the interests of the other.

When a fiduciary is in charge of someone else’s financial well-being, they may be responsible for the general welfare of that individual or group of people (e.g., a child’s legal guardian). There is a fiduciary responsibility for all financial advisors and bankers as well as insurance agents, accountants, executors, board members, and corporate leaders.

What is the meaning of fiduciary responsibility?

Having a fiduciary duty to someone means that you must act in a way that benefits the person you are obligated to serve. The fiduciary is the individual who is obligated to act in the best interest of the principle or the beneficiary.

What are the 5 fiduciary duties?

Care, confidentiality, loyalty, obedience, and accounting are all examples of fiduciary duties.

What Are the 3 Fiduciary Duties to Shareholders?

Three fiduciary duties apply to directors of corporations since they are considered fiduciaries for shareholders. Directors have a duty of care to act in the best interests of the company’s shareholders. Directors have a duty of loyalty to serve the interests of the firm and its shareholders above anything else. Finally, directors have a duty to act in good faith and choose the best alternative for the firm and its stakeholders.

Who is responsible for fiduciary duty?

A director’s duties as a fiduciary include disclosing all relevant information to the company, being honest, loyal, and forthright, as well as prioritizing the interests of the company over his or her own. Furthermore, a director must inform the corporation of any information that has the potential to affect the company’s operations.

Can you sue for breach of fiduciary duty?

Individuals or groups that believe they have been harmed by a violation of fiduciary duty might file a lawsuit if there is reason to believe such duty has been breached. To hold the fiduciary accountable for their acts that resulted in loss, a lawsuit might be launched for breach of fiduciary responsibility.

How are fiduciaries required to behave?

When acting on behalf of someone else, a fiduciary must put the interests of their clients first and must maintain trust and good faith. As a fiduciary, you are legally and ethically obligated to act in the best interest of your client.

How do you prove breach of fiduciary duty?

The plaintiff in a breach of fiduciary duty case must show that the fiduciary (defendant) owed the plaintiff a duty of good faith, openness, and loyalty.

What are examples of fiduciary responsibilities?

Fiduciary duties are taken on by many people for many beneficiaries. Lawyers who represent their clients, CEOs who represent their shareholders, guardians who represent their wards, financial advisors who represent investors, and trustees who represent beneficiaries of estates are just a few examples.

Nguồn: https://spasifikmag.com

Danh mục: Blog