Before buying a water-damaged home, find out who is responsible for making the necessary repairs. Read on if you’re confident that no flooding occurred during your visit. If you discover water damage in a recently purchased home and can’t pinpoint when it occurred, you shouldn’t freak out.

- Who Will Pick Up A Piano For A Donation? Everything To Know!

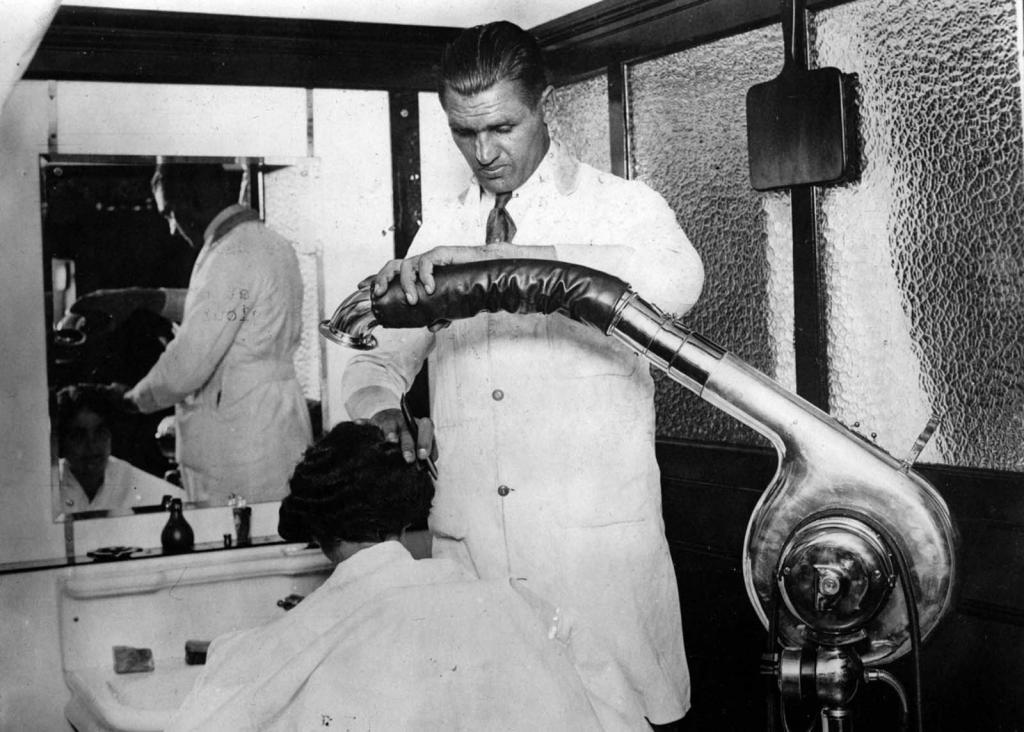

- How Many Watts Does A Hair Dryer Used? Interesting Must Read Facts!

- How To Remove A Hub Cap From A Stroller Wheel? Ultimate Guide

- How To Wash Pack N Play Sheets? Helpful Tips To Remember

- What Curtains Size for 8 Foot Ceilings? Helpful Tips To Remember

Who Is Responsible For The Repairs?

It is your responsibility to determine who is liable for fixing the water damage if you were not notified of it. Your unreported water damage repair could be the work of any one of three people.

Bạn đang xem: What If I Buy Water Damaged House Without Knowing? A Must Read Guide

1. Seller

It is your responsibility to determine who is liable for fixing the water damage if you were not notified of it. Your unreported water damage repair could be the work of any one of three people.

Bạn đang xem: What If I Buy Water Damaged House Without Knowing? A Must Read Guide

2. Seller’s real estate agent

You need to figure out who is paying for the repairs if the water damage wasn’t reported to you. Any one of three people could have worked on your home’s undocumented water damage repair.

3. Inspector

In the event that you had a home inspection done before buying the property and the inspector missed major water damage, you may be responsible for paying for the necessary renovations. A professional inspector is called in to check the property for issues of which the seller might be unaware.

Inspecting the region for water damage is essential, so be sure to check the report. Go on to the next section if that is the case.

How do you determine the repair costs?

To estimate the cost of repairing the water damage to your new home, you’ll need expert assistance. It’s possible that your insurance agent can help you out here.

Inquiring about home insurance is another option. This is because claims for mold growth and water damage are typically excluded from coverage under a standard insurance plan. There would be more costs for whoever is at fault in the event of mold or flooding.

Do you have a legal case in your midst?

House insurance is another option you might investigate. This is because claims for water damage or mold growth are typically not covered by a standard insurance policy. If mold or flooding occurs, the responsible party will have to pay more to fix the problem.

1. Presence of damage before procurement

Inquire as to whether or not your home is covered by insurance. That’s why standard insurance won’t pay for problems like mold and flooding. Mold and water damage would add more expenses for the at-fault party.

2. Someone lied to you

This can be done in a number of different ways. A false ceiling may have been employed to cover up a damaged real ceiling in some buildings. If that’s the case, the seller and the inspector could be held accountable for your loss because of the problem’s concealment.

Also, let’s say you bought a house without being made aware of any previous water damage by any of the aforementioned parties. There may be legal recourse available if the seller represents that all renovations have been completed but are found to be deficient.

Are there alternatives to taking the issue to court?

There are alternative avenues to explore before filing a lawsuit. The infringing party should be served with a formal demand letter. Insist that the water leak’s perpetrators cover the cost of repairs.

Xem thêm : How To Replace A Water Damaged Power Cord? Easy Step-by-step Guide

If the other person still won’t agree to mediation after you’ve described the problem to them, you should ask them to go with you. A real estate lawyer should document and verify all of these discussions.

If the alternatives do not work, then…

Taking legal action may be necessary if the accountable party is unwilling to negotiate. Before opting to go to court, you should consider the following:

Ensure that you are within the deadline

If you intend to initiate a case, you should be aware of any applicable time limits. Find out how much time you have before water damage claims are timed out in your state. Otherwise, the cost of fixing it will fall on your shoulders.

Small claims court or state court

If you wish to file a lawsuit, you can do so in either a small claims court or a state court. The former, however, is more affordable.

Although lawyers are often allowed in small claims court, that is not always the case. If the cost of making repairs exceeds the small claims court’s jurisdiction, the case must be brought before a state court.

What You Need to Know before Buying a House with Water Damage

Schedule a Home Inspection

Possible to buy a house with water damage? A number of other important concerns need to be resolved first, though, before this one can be tackled.

- The source of water intrusion can be determined. A river that’s overflowing its banks, a roof that’s leaking, or a pipe that’s burst?

- To what end did this occur? When was it first spotted, and how long had it been there before that?

- What actions were taken as a result? It seems like we found the solution to the issue. The extent of the damage and the methods used to restore it (e.g., structural repairs and mold remediation). Questions were asked about the condition of the building’s plumbing, electricity, and air conditioning.

- Who paid for whatever maintenance was needed? Is there documentation detailing the restoration’s progress and final results?

- Have any tests been conducted to ensure that the mold problem has been resolved, the water problem has been fixed, and the structure has been restored?

- Whose responsibility was it to pay for those improvements? If the damage was caused by water, will the homeowner’s insurance pay for it?

However, before placing a bid, it is highly advised that you get the property inspected by a qualified specialist. This will give you access to the most detailed and precise data available.

A skilled home inspection will reveal the extent and origin of water damage. Mold growth, foundation fractures, leaking windows, broken pipes, and other concealed dangers will be uncovered by experts. You may make a more educated decision about whether or not to buy the house if you have access to a detailed report detailing any water damage found during the inspection process.

This is a helpful reminder:

- Collect the results of any and all home inspections.

- Be cautious to have a thorough inspection of the home for things like mold and dry rot (the most common results of water damage). Both of these pathogens are notoriously challenging to identify, have a high potential for spreading to other materials, and can result in extensive structural damage in addition to serious health problems. Your hired inspectors will have to look in tight spots such behind wallpaper and beneath rugs for signs of water damage. In order to determine the full extent of the damage, it may be necessary to break down barriers or conduct other types of specialist testing. In order to discover all of the threats and put your mind at ease, you need the assistance of mold remediation experts and wood construction professionals who have years of experience and a solid track record in their respective fields.

Consult a Contractor and Get an Estimate

After the inspection is finished, a price quote for the necessary repairs can be obtained.

If you want an accurate estimate of how much it will cost to restore your home after water damage, you should get estimates from at least three or four different companies. Inquire about the price of fixing the damage and cleaning up any mold that may have grown as a result of the water leak, and be sure to bring the report from the home inspector with you.

The professional evaluations are necessary for making a fair offer to the seller. It is recommended that you give each professional as much time as possible to evaluate your home and assess the damage there. If the contractor suspects water damage, he or she will require the homeowner’s written permission to perform any intrusive testing or to open walls.

Evaluate the Repair and Remediation Costs and Submit Your Bid

Water damage to a home is a serious issue. There may be serious structural issues and mold growth in the home you’re thinking about buying (water can easily seep through the walls and soak the drywall, insulation, and structural supports, especially if the problem has been unattended for a prolonged period of time). It’s possible that getting repairs done will take a long time and end up costing you a lot of money.

When estimating a bid for a water-damaged property, it is important to include in the costs associated with repairs and mold removal.

- Determine the home’s current market value by inquiring with a few local real estate agents about comparable sales in the area;

- Using the results of the home inspection and estimates provided by the contractors, you may estimate how much it should cost to repair the water damage.

- Do not include in the expense of repairing water damage to the home into the asking price. If you look at this figure, you can determine how much money you should offer for the house (however, you may want to make a lower offer at first in order to open negotiations with the seller).

Xem thêm : The Quick And Easy Way To Remove The Swivel Off Your Recliner

Once you have collected all of the information, it is time to speak with a real estate professional. Sellers may reduce their asking price to account for restoration expenses, or they may agree to undertake necessary repairs before a sale is finalized.

Make sure the price you offer the seller accounts for the cost of fixing any water damage.

When closing a deal, it is important to obtain a copy of the sales contract and check that the terms regarding water damage payments are accurate. Consult an attorney if you have any queries about the contract’s terms and conditions.

Obtain Homeowner’s Insurance Quotes

Before you put pen to paper, there’s one last thing to think about: checking your insurance options to make sure your new house is properly protected.

When buying a home that has mold or water damage, it’s best to have a policy that covers everything. Get in touch with a few different insurers in the area to find out if you’re covered in case the water damage from before returns. You should research whether or not water damage insurance has any special conditions or exorbitant costs. If home insurance is either too expensive or provides little protection, buying a house may not be a good financial move (or nonexistent).

If the home you’re interested in buying is located in a flood plain or an area with a high risk of water damage, you may need to purchase additional flood insurance (most general home insurance policies do not cover floods). If you need flood insurance, you can contact your real estate agent for a list of local companies that offer it, or you can inquire around your community for recommendations.

Once you and the current homeowner have reached an agreement on the terms of the deal, you can move forward with closing. Water damage restoration costs and timeframes increase proportionally with the amount of time and money you wait to start fixing the problem after it has occurred. If you want to be able to settle into your new house as soon as possible once water damage has been repaired, be sure to pick professionals with a solid track record.

Buying a Home After Water Damage: 4 Questions to Ask

What Was the Extent of the Damage?

A home flood can cause a broad variety of damage depending on the home’s location, the type of flooding, and the intensity of the flood. Broken pipes in the winter are very different from the damage caused by a frozen river or a burst water heater that dumped hundreds of gallons of water in a basement. If the occurrence falls inside the purview of the seller’s insurance coverage, a claim should contain estimates of damage and suggestions for repairs or replacement. Therefore, you should ask for a copy of this list, since it will specify where the damage occurred and how much of it there was.

Which Repairs Have Been Completed?

Those interested in purchasing the home should verify that all maintenance items on the inspection report have been addressed. In some cases, you can save time and money by making repairs on your own. It may not be a top priority to replace items that initially appeared unharmed. Because everyone has their own opinion of what’s important, a system must be put in place to keep track of which jobs have been completed and which have not. Invoices for costly repairs or replacements should be kept in case further assistance is required down the road. Collect and store all of this information in one convenient location. If most of the needed repairs have not been performed after two years, it may be more beneficial to go elsewhere.

Has the Cause Been Identified and Fixed?

In some circumstances, preventing more flooding is more important than restoring the initial damage. In the haste to get everything back to normal, preventable damage may be overlooked. Determine the source of the water. Burst pipes are a recurring problem in homes where the plumbing lacks proper insulation. If your water heater keeps dripping, it’s time to replace it. It is suggested that efforts be taken to grade the land properly and provide a backup in case of a major rainstorm to prevent further floods (such as a sump pump).

Are There Any Long-Term Problems?

Saturation from water can have lasting effects even after water damage has been corrected. Mold, for instance, may grow behind the walls if they were flooded over an extended length of time. Inquire about mold testing details to make sure you and your loved ones are safe. Weigh all the information at your disposal to determine whether or not the sellers have done a satisfactory job of preparing the home for a new family to call it home. If not, then you should look into your alternative options.

Although every house in existence has a story to tell, some are scarier than others. If there are any warning signs in the water damage to the house, they can be found by asking these questions. If the facts appear to be in order, you will have more faith in your understanding of them. If the knowledge given to you causes you to turn around and run in the opposite direction, you will have avoided a catastrophic mistake.

Conclusion

We understand the worry about purchasing a water-damaged home without knowing it because finding the right home may be challenging. Before making a final purchase, it’s important to carefully consider all of your options.

Communicate with the real estate agent to serve as a gentle reminder. For the off chance that it has already happened, however, we have compiled the following advice. Make good use of it, thanks!

Nguồn: https://spasifikmag.com

Danh mục: Blog