Have you ever been curious about the tax implications of plasma donation? You don’t have to wonder any longer, because we’ve got all the information and crucial points you need to know about how to write plasma donation on your taxes.

Donating plasma for the money doesn’t appear to be a factor in many people’s decision to do so. A tax preparer from one of the big box tax return groups may have told you that your donation was not taxable revenue, and that’s why you made it. It’s possible that’s not the case, though.

Bạn đang xem: How To Report Plasma Donation On Taxes? Ultimate Guide

In place of trusting your plasma donation tax questions to a random tax accountant who is unlikely to have the knowledge and skills to answer them, we will assist you with your queries on how to report plasma donation on taxes.

Why Plasma Donations Are Taxable

Donating plasma is sometimes misunderstood as simply “donating” and many individuals feel that plasma donation revenues should be tax-exempt.

As a ‘plasma’ contribution, it is also considered that it should be tax-free, since it is a ‘body fluid.’ People assume that because body fluids cannot be taxed, plasma donations are exempt as well. That, however, is not the case at all.

Many people find the idea of donating plasma as a form of taxable income intriguing. The following are some of the possible tax benefits of plasma donation:

1. Large Monetary Gain

If you donate plasma, you may be compensated with a large sum of money, which makes it subject to taxes. It’s worth a lot of money, especially if you’ve donated plasma multiple times, and that money is deductible from your taxable income.

2. Self-Employment

Plasma donation tax is the same as self-employment tax for donors who have been in the business for some time and have amassed a significant sum of money. They are not, legally, exempt from paying this tax.

Plasma Donation Requirements And Eligibility

Even if you get paid for it, plasma donation is a good deed.

If you’re thinking of giving plasma for the purpose of making some extra cash, you’ll want to be sure you fit the eligibility conditions. To put it another way, see if you’re qualified to donate blood or plasma to someone in need. Donating plasma becomes unethical if you don’t meet the eligibility requirements. This can put the receivers’ health at risk.

To begin your journey as a plasma donor, here are some of the standards you’ll need to meet.

- Between the ages of 18 and 65

- Have a legal document to prove your citizenship.

- As much as 50 kilograms (110 pounds)

- Free of any contagious illnesses

- Without any significant health issues

- Sufficient quantities of various blood components in a CBC report

- There is no family history of cancer.

- No previous exposure to hepatitis B or HIV.

- Within a year, no body piercings or tattoos.

You can donate plasma if you meet the following criteria. It is still recommended that you have a physical examination before donating plasma in order to ensure that your health is suitable for the procedure.

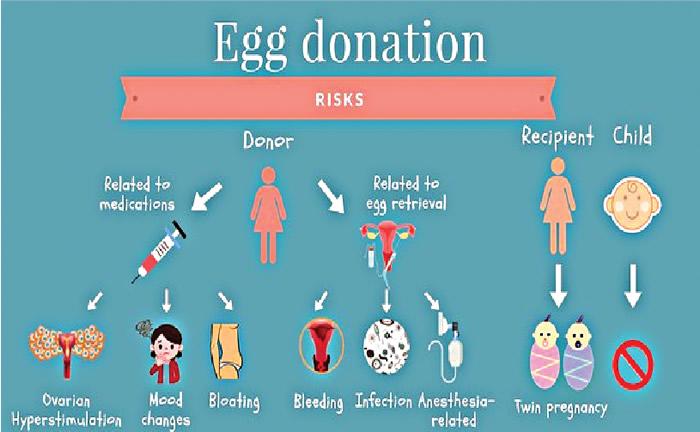

Risks And Side Effects Of Donating Plasma

Plasma donation, no matter how noble the cause, can be hazardous to your health if you aren’t careful. Plasma donation is fraught with dangers and complications, especially if you don’t know what you’re doing. First-time users should take extra caution because the negative effects can be much more severe.

The following are the most common side effects associated with plasma donation:

Dizziness

The most prevalent negative effect for plasma donors, especially those who have never done it before, is nausea. The body’s oxygen flow is reduced when plasma is temporarily reduced, which might cause a minor dizziness.

Getting up from a sitting or laying position can cause dizziness, which might worsen with movement. However, this normally subsides after six to eight hours because your bloodstream’s oxygen supply returns to normal.

Fatigue

The feeling of exhaustion that follows dizziness is caused in part by uneven oxygen delivery throughout the bloodstream. After a good night’s sleep and some rest, it’s typically gone.

Discoloration

When a needle is inserted into a vein incorrectly, it can cause discoloration and symptoms of bruise. It can be painful and linger for a few days, but it’s not uncommon.

Dehydration

Plasma donation can cause dehydration, which is a serious complication. Blood volume and mineral content are reduced as a direct result of frequent plasma donation in the short period of time.

As a result, after a plasma donation, be careful to drink enough of fluids. Dehydration can lead to seizures in extreme circumstances, thus it should be taken very seriously.

Plasma Donation Are Eligible For Tax Deduction

The donation is tax-deductible because it is a charitable one. As it stands, the term “plasma donation” is somewhat misleading. It doesn’t matter what you think of the process when you’re selling something and making money—the constitution still applies. Internal organs, blood, and other bodily fluids cannot be taxed. When discussing whether or not plasma donations should be taxed, this is a common remark. Think about it in a different light. If you contributed your eggs or worked as a paid surrogate, then you are a surrogate.

However, despite the fact that it would be a kind gesture, practically all of these goods come with financial compensation in the six-figure range, all of which are subject to tax. Plasma donation may be on a smaller scale, but it is tax deductible because it is considered the same as using bodily fluids or organs for financial advantage.

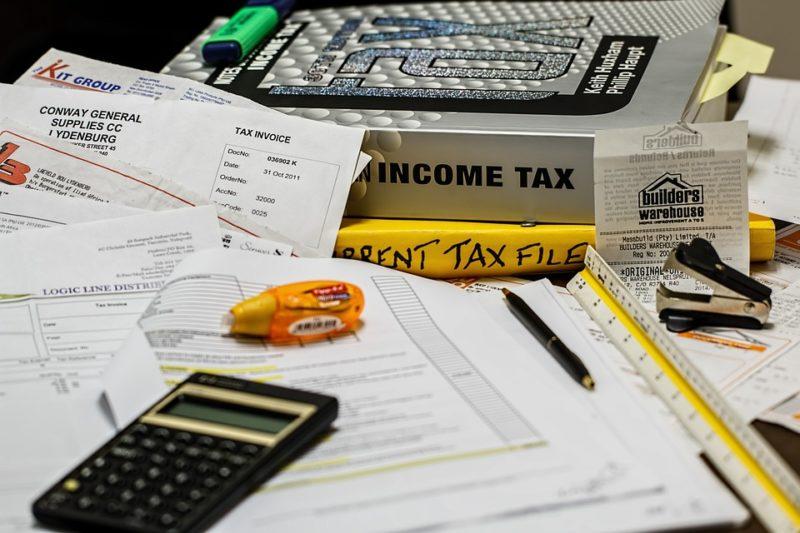

In the eyes of some, the fact that they did not get a Form 1099-MISC means they shouldn’t be required to pay federal income taxes. To ensure that nothing goes awry, all significant corporations must now send independent consultants 1099-MISC forms to help them file their tax returns. Even if a 1099-MISC isn’t issued by every plasma clinic, you’re still responsible for paying your taxes nonetheless. Line 21 of Schedule 1 Form 1040 must be used to declare plasma donation income; alternatively you can use our accountant to assist you with your tax return.

What Is Misc Revenue Form: 1099-MISC?

IRS Form 1099-MISC: Miscellaneous Income (or Miscellaneous Documentation) is a form used by the IRS to notify specific types of income such rent, prizes and awards, healthcare payments and payments to an attorney. It will be renamed in 2021. This non-employer compensation will be reported on Form 1099: Non-Employer Reimbursement beginning in 2020, which has been used to review compensation for independent consultants, self-employed individuals, and sole proprietors prior to the 2020 federal income year.

How To Report Plasma Donation Through Online?

Select Wages & Revenue, and then select I’ll choose what I work on on the new screen that appears.. The Less Common Income area is located at the bottom of the Your Earnings Overview display. The Start/Update icon next to the Miscellaneous Income, 1099-A, 1099-C category can be clicked to begin the update process. Next to Other, select the Start/Update option. That’s how plasma donation is reported on tax returns.

Why Do People Engage In Plasma Donations?

To supplement their primary income, most plasma donors give up a small sum of money each week. There has been a rise in the number of people who have many side jobs, such as working for a ride-sharing business or donating plasma. Having a lot of side hustles can make it harder to file your taxes. Trust us, you’ll be in a very difficult situation if those charity contributions start to pile up, making it difficult to report on your taxation in the long run.

Xem thêm : Is It Okay For A Treadmill To Get Wet? How To Fix Water Damaged Treadmill?

When it comes to your plasma donation, you may be able to just enter your income on Line 21 and be done with it. However, this may not be enough for you if your income is low. Donating plasma on a regular basis might lead to an impressive amount of plasma being stored in your system. Donating plasma can result in a substantial monetary refund, which is taxable income. If you’ve provided a lot of plasma over the years and it’s taxed, it can be worth a lot of money.

Your Plasma Donation May Be Taxable

Because many people assume that their plasma donation revenues are tax-exempt, we must first address this issue.

Because it’s a contribution, there’s no tax on it. It’s a little misleading to call it a plasma donation because you don’t get paid for it. When you sell anything and make money, it doesn’t matter what you label the process; you still need to follow the law.

A biological fluid or a body portion cannot be taxed. This is a common argument in the debate over whether plasma donations should be treated as taxable income. However, let’s take a different approach to this. Suppose you were a paid surrogate or contributed your eggs to someone.

However, each of these items come with thousands of dollars in remuneration, all of which must be reported as taxable income. In the same way as the use of human fluids or body parts for monetary gain is taxable, plasma donation is on a smaller scale.

To avoid taxes, I did not obtain a Form 1099-MISC. Companies should issue 1099-MISC forms to their independent contractors to make tax preparation easier for them. Even if your plasma center does not issue a 1099-MISC, you are still responsible for paying your taxes regardless of their failure to do so. Line 21 of your Schedule 1 Form 1040 must be used to report your plasma donation earnings, or you can have our accountant assist you with your tax preparations.

It has also been argued in the famous case United States v. Garber that plasma donation compensation should be taxed. Even though Dorothy Garber was paid directly by firms for her plasma because of the unusual Rh antibodies in her plasma, her conviction for tax evasion can serve as a precedent for others.

Because of the precedent set by plasma donation payments being taxed, you don’t want to end up in hot water with the IRS.

Pitfalls Of The Side Hustle Economy

Donating plasma is typically done as a means of supplementing one’s income, rather than as a primary source. Multiple side hustles, such as freelance work, driving for ridesharing firms and plasma donation are becoming more frequent. The problem is that many side jobs can complicate your tax situation significantly.

It’s possible that you can just enter your wages on Line 21 and be done with it when it comes to plasma donation. In other cases, however, that may not be sufficient. If you donate plasma on a regular basis, you may amass a sizable sum of money in the United States, where contributions can vary from $30 to $50.

Let’s imagine your local plasma donation center pays $30 per donation and you contribute twice a week to see how your earnings can add up. That works out to $60 a week. You can earn an additional $240 in a month. If you donate plasma every week for the entire year, you can make $3,120.

Plasma donation centers often give donors a discount for donating on a regular basis, thus these figures are understated for someone who routinely donates plasma. However, this can leave you in a difficult position when it comes to taxes.

A Schedule SE must be filed if you earn more than $400 from your side hustle and that income is deemed self-employment income. Self-employment income is subject to Medicare and Social Security taxes. Self-employment taxes may be required if you donate plasma on a semi-regular basis.

Work With AA Tax & Accounting Services On Your 2019 Tax Return

Donating plasma can complicate your tax return, as you can see. Instead of facing an IRS audit and paying fines, you can rest easy knowing that your taxes are in good hands with an accountant you can rely on.

Make an appointment with our accountant if you want to work with him or her on your 2019 tax return. As a result, you’ll be able to file your taxes with total peace of mind this year.

Frequently Asked Questions

What is Blood Plasma and Why is it Needed?

There are no cells in plasma, yet it includes protein and antibodies, as well as other nutrients. It is essential for treating individuals who have suffered trauma, burns, or low blood volume. Patients with liver disease or other health issues may also require plasma transfusions.

What is Donated Plasma Used For?

Those with chronic health conditions, major health difficulties connected to a shortage of immunoglobins and clotting factors, blood illnesses, and unusual genetic disorders can all benefit from donated plasma treatment.

How Long Does Donating Plasma Take?

It takes about an hour and fifteen minutes to donate plasma. The process of donating plasma from the source might possibly take as long as two hours for beginners. Medical supervision is required throughout the entire procedure, which includes extracting blood and removing plasma from it.

Are There Long-Term Side Effects of Donating Plasma Frequently?

In the same way as plasma donation is harmful if done regularly, nothing is good if done infrequently. Donating plasma on a regular basis can result in long-term negative effects such anemia (a low level of red blood cells). Severe weakness and exhaustion are common symptoms of this illness.

How Often Can You Donate Plasma?

Even though you can donate plasma every 28 days, it’s best to space out your first few donations over a period of months or even years. If you notice your health declining after each plasma donation, you can take a break. Plasma can usually be donated 11-12 times per year.

How will I get payments for my plasma donation?

CSL Plasma compensates plasma donors for the time and effort they put into donating their plasma. Your donation is promptly deposited onto a reloadable card when you complete your transaction. Life-saving plasma donations can bring in more than $1,000* in the first month for eligible, qualified donors. If your favorite CSL Plasma collection center is taking part in any other promotions, be sure to check with them.

Donors may also opt to join the iGive Rewards® donor loyalty program, which earns you points for every completed donation. You can redeem the points anytime for Fast Cash or special Deal of the Day merchandise when available. The more you donate plasma, the more points you receive, and the rewards get better as you acquire higher status: Bronze, Silver, Gold or the exclusive Platinum level.

I’ve lost my reloadable card. Who can I contact?

iGive Rewards®, a donor loyalty program, is another option for donors who want to earn points for every completed donation. To use your points for Fast Cash or a limited time offer of Deal of the Day products, you can do so at any moment. With each donation, you earn points toward a higher level of status, from Bronze to Silver to Gold, and finally to the coveted Platinum.

Call 1-877-855-7201 for a prepaid Blue/Platinum/Card. Veteran’s

You can get a prepaid Red Card by calling 1-866-CSL-0200.

Cardholders of Bank of America should dial 866-692-9282.

It will be issued a new card, and the funds will be transferred to the new account.

What are the requirements to be a plasma donor?

Xem thêm : How To Get Doctor To Extend Maternity Leave?

If you are between the ages of 18 and 65, in good physical condition, weigh at least 110 pounds, and have no recent tattoos or piercings, you are eligible for this program. Please consult a member of our medical team at the plasma clinic nearest you for a complete list of donation requirements.

Do I need to make an appointment to donate plasma?

You won’t have to worry about making an appointment. Find the CSL Plasma center hours of operation near you by clicking here.

What is the location of the nearest CSL Plasma collection center and its operating hours?

Please click here to see whether there is a CSL Plasma facility in your neighborhood or if a new facility will be opening soon. In order to better serve you, most CSL Plasma facilities are open from Monday through Sunday. To learn more about CSL Plasma, please contact your nearest location.

In terms of marketing, this is the radius in which a

Each center’s location determines the marketing radius. Please contact your local CSL Plasma center to find out if you are within the marketing radius of a center.

How often can I donate plasma?

Only once in a two-day period, and no more than twice in a seven-day period, may you donate plasma, according to FDA regulations.

What is a deferral?

Your Center Manager has the last say on all donation eligibility decisions, including temporary or permanent deferrals. There aren’t any go backs.

What do I need to bring besides my ID?

Certain forms of identification are required before a person can contribute. A valid form of identity, evidence of residency, and a social security number are all requirements. A piece of mail postmarked within the last 60 days with your name and address plainly written on the envelope, a valid lease, and so on are all acceptable forms of proof of residency. To learn more, please get in touch with a CSL Plasma center near you.

Who do I contact about medical questions?

Medical Staff Associates and/or the Center Manager should be contacted with any inquiries regarding donation eligibility, including prescription drugs, medical conditions, and medical procedures. As a result, please get in touch with your neighborhood CSL Plasma facility.

How does CSL Plasma accommodate donors with disabilities?

Take a look at what we’re doing to help people with a variety of impairments.

What is iGive Rewards?

iGive Rewards®, our donor loyalty program, allows you to earn points for every donation you make. It is possible to redeem your points for cash or other promotional things at any time. More plasma donations get you more points, and the incentives improve as your status rises from Bronze to Platinum. You can see how many awards you’ve accrued by logging into your account today.

What information do I need to log in to iGive Rewards?

The last four digits of your donor number, your last name, and your date of birth can be used to enter into iGive Rewards®. The final four digits of your donor number can be obtained by contacting the CSL Plasma donation center of your choice and asking for this information.

Where can I access iGive Rewards?

iGive Rewards® can be accessed by clicking here or by downloading the CSL Plasma mobile application.

How do I earn, review and use iGive Rewards credits?

It is possible to earn iGive Rewards® credits by completing donation forms or surveys, as well as participating in special campaigns and deals.

Selecting the “My Donations” button in your iGive Rewards® donor loyalty account will allow you to access all of your credit history (donations, surveys, membership levels, and account activity).

If you go to the “Online Store,” you’ll be able to select from a range of incentives. The checkout process is as simple as redeeming your points and completing your purchase. Your reloadable prepaid card is reloaded within 24 – 48 business hours after you place a Fast Cash order. Within 4 to 6 weeks of placing an order, all tangible things are sent. In the absence of specific instructions, orders are shipped to your designated CSL Plasma donation location.

Your preferred CSL Plasma donation location is the best place to modify your address if you need to. Your iGive Rewards® profile will be updated with your new address in 24-72 hours after you make the change.

How long does it take for donation credits to post to my iGive Rewards account?

Seven days after the end of the month, your donation credits will be deposited into your account.

What is the E Rewards Survey?

Please take a moment to complete the E Rewards Survey and let us know how we’re doing by nominating your favorite workers.

Do iGive Rewards credits expire?

the following conditions are met:

1) Donations haven’t been received in 30 days or more.

If you don’t log in to your account for at least 180 days (6 months),* you will be suspended from the service.

After 180 days of inactivity, points will continue to expire monthly (every 30 days) until the next log-in happens.

What are the membership levels for iGive Rewards?

iGive Rewards® has four tiers of membership: Bronze, Silver, Gold, and Platinum. There is a 12-month rolling schedule that determines membership levels. Log in to see the complete list of rewards and donation requirements at each level.

How do I opt in and sign up for special email and/or text messaging offers and promotions?

To join, you have two options. Once logged in, pick the ‘Email/Text Messaging’ icon from the home screen, or 2) Select the ‘My Profile’ link on top of your home page and adjust your communication choices. Sign up with your email and mobile phone number to receive exclusive offers from CSL Plasma by opting in and saving your choices.

In the future, CSL Plasma will notify you of upcoming promotions in your area. In addition, you can be alerted through email or text message if there are any weather-related closures.

Conclusion

Finally, it may be claimed that plasma donation, despite the fact that it rewards you every time you donate, is a good and morally upright endeavor. Due to the fact that it is a form of self-employment and generates a considerable amount of money, it is subject to taxation.

Nguồn: https://spasifikmag.com

Danh mục: Health