Cash, cheque, and credit card payments can all be tracked in QuickBooks. To ensure that the right tax deductions are taken at the end of the year, these revenues should be reported as donations. Create a sales receipt form instead of inputting a donation as a deposit to create additional tracking options, such as the donation type, program, or source. An audit that takes advantage of this data might save a lot of time.

Steps To Record A Donation In QuickBooks

- Open QuickBooks and get started. Enter Donations (Sales Receipts) from the drop-down option in the “Nonprofit” menu.

- In the drop-down menu, select “Customer Job” and select an existing donor or grant-giving entity.

The “Add New” option will allow you to create a new donor or grant if you don’t already have one set up.

Bạn đang xem: How To Record A Donation In Quickbooks? Complete Step-by-Step Guide

- After that, select the item from the item column that matches the donation type. To add a new item, simply pick “New” from the “List menu” after clicking on “Item List.”

- Select “Type” and then “Service” from the drop-down menu.

- Choosing “Account” from the drop-down menu will allow you to designate the bank account to which donations should be deposited.

- Select the appropriate fund or project in the Class column. A good example of this would be a contribution made to a certain charity.

- Select “Customize” from the drop-down menu to add/remove any fields that you need to help donors if necessary in the Amount field.

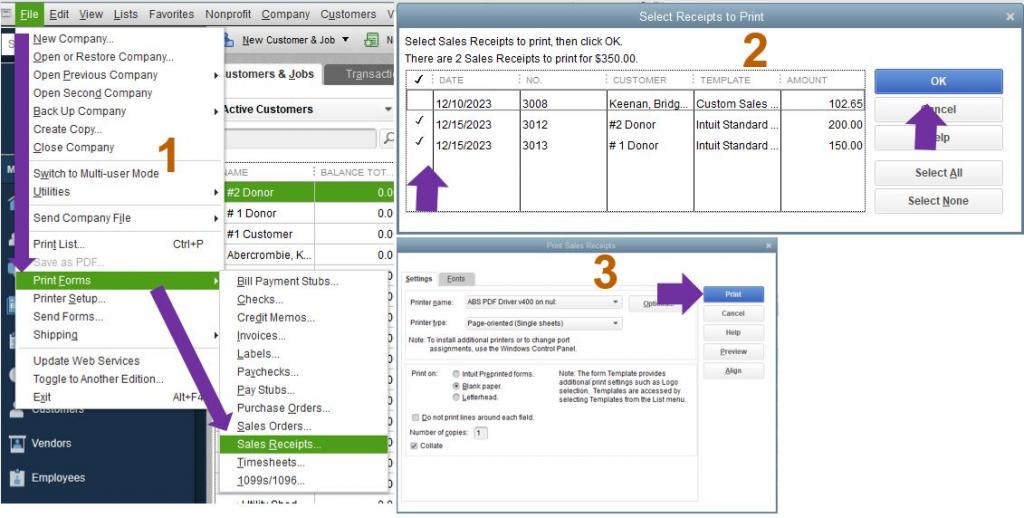

- Select the “Print” option on the sales form to print the form.

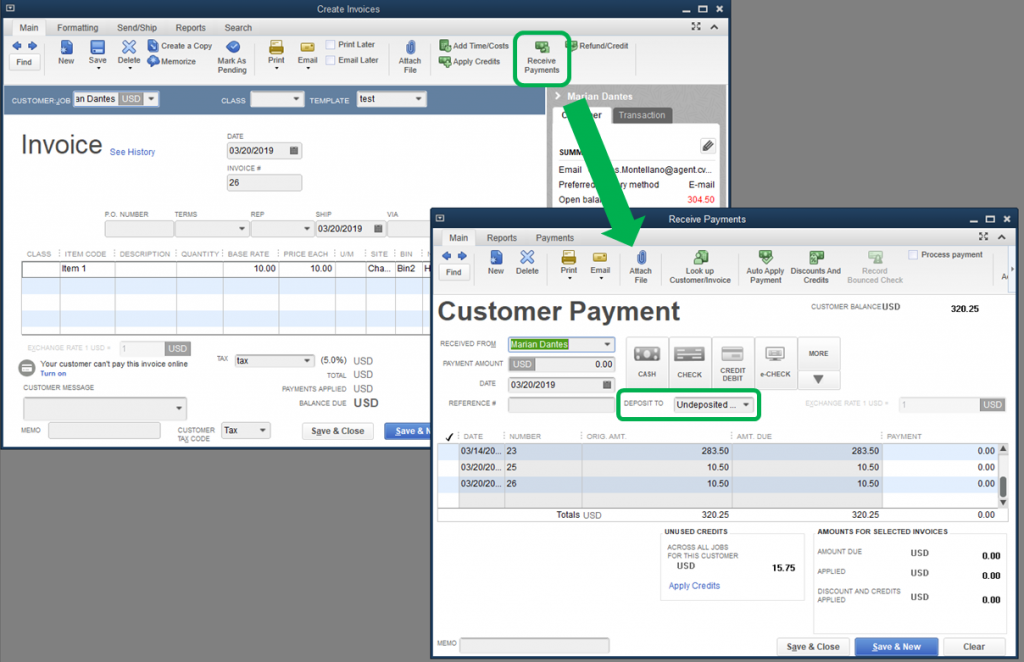

- You can use the “Deposit to” drop-down list to specify the account to which the deposit should be made, if necessary. Due to a lack of direct charitable donations, this area cannot exist.

- Finally, save and exit.

Please take note that the procedures outlined above are valid for QuickBooks 2013. Other versions or goods may have minor differences from this one.

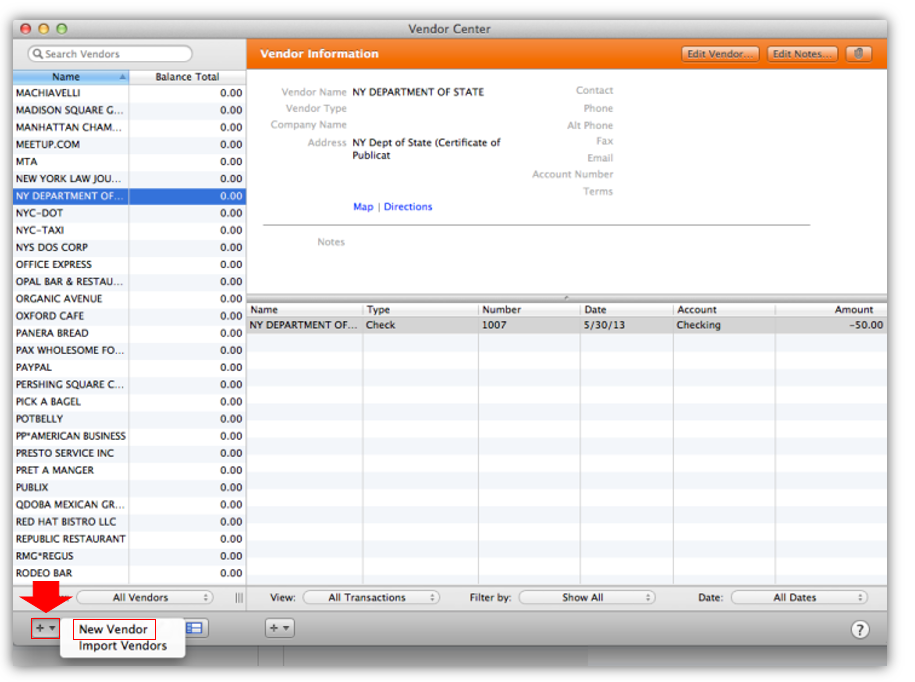

Steps to Record a Donation in QuickBooks Point of Sale

Step 1

- Go to the Customer center in QuickBooks Point of Sale and select “Create sales receipt.”

- To add a new customer, select “Add new” from the Customer menu and enter the name of the specific organization to which you donated an item.

- Donate an item by filling in the blank fields labeled “Item” and “Description,” as well as providing a brief description of the item’s condition or qualities.

- Enter a dollar amount equal to your item’s worth in the Amount field below the item quantity drop-down selection.

- Select “I want to” next “Change tax location” and then “Exempt” afterward.

- Select “Save” from the File menu.

Step 2

Keep track of your charitable donations by opening a spending account for the money you’ve already given away.

- Select “Chart of accounts” from the “List” option in QuickBooks.

- “Account,” “New,” and “Continue” are all options you can choose from.

- Enter a name for this account in the Account Name area such as “Considerations of Interest” when prompted.

- Select “Save and Close” to save the account at the end.

Step 3

- To make a charity donation, go to the “Banking” page and input your check number.

- As a last step, click “Write check.”

- Select a bank account from the drop-down option to pay check expenses.

- Using the “Make Payments” field, select “Add New” and write in the charity or organization you made a check to.

- Make sure to fill in all of the essential fields, including the check number, the date, and the amount of the check.

- When donating money, select “Itemize by account” from the drop-down box and enter the name of the account you used to make the donation.

- To save money, select the “Save” option.

Donation In Quickbooks Point Of Sale

Logging into your account and selecting “Create Sales Receipt” in QuickBooks Point of Sale will allow you to record a gift. then select “Add New” and enter the name of the charity you donated to.

The date, the item, and the description of the item you’ve donated must be entered into the form. You can type in the item’s condition or other qualities, as well as the year it was made. Indicate how many of each item you’ve donated, and then include the corresponding amount in cash. If you want to avoid paying taxes on it, you can select the option to change the tax location and then save the form.

#1. Spending account

First, go to the list menu after logging in, and select “Charts of Accounts” from the drop-down menu. Choose a new account from the menu and fill out the form that appears on your screen. As a last step, save the file with a name that will allow you to identify the account itself.

#2. Banking

For receipts and checks, go to “Banking” after opening a spending account. Enter your bank account information and then click on “Write Check” to pay your bill. Choose “Add New” from the drop-down menu and enter the name of the charity you’d like to support in the “Payment To” field. Afterwards, add the date, check number, and any other important information. Save the name of the account you want to contribute to by selecting “Itemize by account.” Everything, including your costs and account, will be saved if you press the save button.

How do I categorize donations in QuickBooks?

Xem thêm : Where Does My Blood Donation Go? Comprehensive Guide

Listed below are the steps to complete each one:

- Open the Settings menu.

- Select a Chart of Accounts.

- To begin a new project, select the New option.

- Select Expenses from the Account Type drop-down list in the Account dialog.

- From the Detail Type drop-down menu, select Charitable Contributions.

- Give the account a name (for example, Charitable Contributions).

- Select the Save and Exit option.

How do I record a donation transaction?

It is generally agreed that in-kind gifts should be documented in a separate income account, while the transaction’s expenses should be recorded in the account that serves as the transaction’s functional expense. A gift in kind is documented as a service, while a professional service is recorded as a cost.

Is a donation an expense in accounting?

If a donation is made as a business expense, it is deductible for tax purposes. If you don’t own a business, only charitable donations are tax-deductible.

Is a charitable donation an expense?

To qualify for a tax deduction, businesses must donate to legitimate non-profits. This contribution is not deductible on Schedule C. Expenses like this are not deductible for self-employment tax purposes. In the eyes of the IRS, it is a business expense that is paid for by personal cash.

Conclusion

It will be much simpler to enter and track your business expenses in QuickBooks now that you know how to report a contribution. As a result of QuickBooks, you won’t have to worry about managing your finances ever again. Please also check out these articles on how to set up a PayPal donation and how to design a donation flyer.

Nguồn: https://spasifikmag.com

Danh mục: Health